Written by Michelle Ravenor

Policy Officer at Independent Age - working on Income.

click to read original article on Independent Age website

Following the release of our new report, Policy Officer Michelle Ravenor explores who is most likely to face income inadequacy and how the UK Government can ensure everyone is able to live well in later life.

Women, disabled people, unpaid carers and people from racially minoritised groups are some of those most likely to be living with a low income as they get older. Our new report — ‘Too little, too late’ — uses data to shed a light on these inequalities and shares the stories of people impacted by living on a low income in later life. Our report aims to amplify the voices of older people in financial hardship as we push for change, and we’re grateful to over 2,000 of our supporters who completed our survey.

“None of my employers offered a pension to a female in the 1970s. Then I had two children and worked part time, which also never offered me a pension. Buying our own home, raising two kids, food, bills etc prevented me from affording a private pension.”

Elaine, 69“I am registered blind and have had major sight impairment since I was four. I was never able to get jobs that paid above minimum wage (when I was able to get a job at all) due to my disability, so no chance to get a private pension.”

Anonymous, 66–70“Wasn’t well paid enough to have a private pension and spent many years caring for elderly parents until their deaths — and then became an unpaid kinship carer for my grandson.”

Kathryn, 66

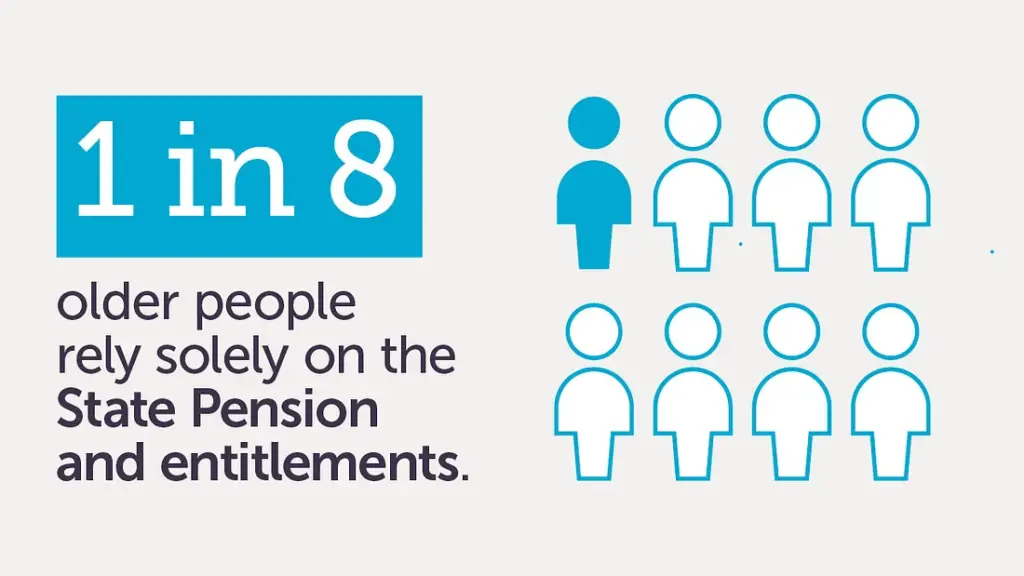

These insights into people’s experiences during working age, show why for so many it was extremely challenging or even impossible to save even small amounts into a private or occupational pension. For an older person reaching State Pension age with little or no private or occupational pension, the State Pension and state entitlements (or ‘benefits’) system make up all or most of their income.

Did you know?

- Millions of part-time workers were legally excluded from their workplace pension schemes until the 1990s — this routine practice affected mainly women who were (and remain) the majority of part-time workers.

- Weekly private pension income for women born in the 1940s and 1950s may be 45–60% lower than for men of the same age.[1]

- For every year that an unpaid carer is out of paid work, they lose an estimated £5,000 from their pension pot. Over 6 years, for instance, this could lead to a 13% loss in pensions savings.[2]

- Only 33% of Asian/Asian British and 37% of Black/African/Caribbean/Black British pensioners receive an occupational pension, compared to 64% of white pensioners.[3]

Today’s generation of older people are feeling the impact. Growing numbers of pensioners live with an income below widely recognised minimum living standards, such as the Joseph Rowntree Foundation’s (JRF) Minimum Income Standard (MIS). This standard gives a measure of income that the public believe is needed to achieve the minimum acceptable standard of living and is widely respected.

The latest data shows that the likelihood of living below the MIS for single people above State Pension age has more than doubled between 2008/09 and 2022/23, from 17% to 35% — that is, from 700,000 to 1.5 million people. This is an issue that affects older women: of the single pensioners living below MIS in 2022/23, 1.1 million (70%) were women and 500,000 (30%) were men [5]

Alongside this are growing numbers of older people living in ‘material deprivation’ — this is a government measure of poverty indicating whether a household can afford basic items and carry out activities that are deemed to be essential. For example, someone is considered to be in material deprivation if they cannot afford to have more than one filling meal a day, or cannot afford to live in a damp-free home. The most recent data shows that 11% of people above State Pension age — 1.3 million people — now experience material deprivation.

And while there are entitlements designed to improve people’s income and living standard, such as Pension Credit — often these are not enough. 20% of people who receive Pension Credit remain in income poverty.[6] Our welfare safety net is not working for all.

If the Labour government are to achieve their mission of “Higher Living Standards across the country”, then the adequacy of the State Pension and social security system must be addressed. They must listen to the voices of older people living on a low income, to change their lives for the better.

It is time for the UK Government to agree on what an adequate income in later life should be, working with other parties, experts and older people themselves. We believe that in a fair society, everyone should live with dignity, purpose and choice in older age — having an adequate income is a key part of this, and changes to the social security system are needed to make this happen for all older people.

We’ll continue to campaign so that the UK Government takes the urgent action we need to see to tackle poverty in later life. If you haven’t already, you can subscribe to our regular newsletter to keep track of our progress and find out how you can do your bit to keep up the pressure on decision-makers. You can sign up here.

If you or someone you know is struggling, we’re here to help. Call our free Helpline on 0800 319 6789 or find advice and support through our website.

Read more on these findings in the ‘Too little, too late’ report.

Endnotes

[1] The gender gap in pension saving, Institute for Fiscal Studies, 2023, see ifs.org.uk/sites/default/files/2023–03/IFS-REPORT-R250-The-gender-gap-in-pension-saving.pdf.

[2] The Carer’s Pension Gap, Pension Bee, 2023, see pensionbee.com/uk/carers-pension-gap.

[3] Pensioner’s Incomes Series 2023/2024, Department for Work and Pensions, 2025, see gov.uk/government/statistics/pensioners-incomes-financial-years-ending-1995-to-2024.

[4] Pensioner’s Incomes Series 2023/2024, Department for Work and Pensions, 2025, see gov.uk/government/statistics/pensioners-incomes-financial-years-ending-1995-to-2024.

[5] Households living below a Minimum Income Standard: 2008–2023, Joseph Rowntree Foundation, 2025, see jrf.org.uk/households-living-below-a-minimum-income-standard-2008–2023.

[6] Households below average income (HBAI) statistics, Department for Work and Pensions, March 2024, see stat-xplore.dwp.gov.uk/webapi/jsf/login.xhtml.